Using credit cards for your company's payroll

The CardUp Team

Sep 23, 2020 1:28:00 PM

喜歡用英語閱讀?請點擊上方的語言切換功能來更改您的語言。

For any business, payroll makes up a sizeable portion of monthly overheads, ranging anywhere from 20% to 30% of a business’ expenses. Yet, when a business experiences a cash flow crunch, these payroll expenses might not qualify for financing easily. Lenders typically only support loans that will be used by companies to grow their business, such as for investment in machinery or tech, which better assures them of repayment.

Cutting this expense out isn’t a possible option either, as there are many heavy repercussions on your company — a negative impact on your employees’ morale and a big hit on your company’s stability.

With 45% of Hong Kong SMEs facing delayed payments for two months or more from their customers, this large percentage of overheads in payroll is unavoidable, which severely limits and impacts working capital on hand. Imagine if there was a way to put this large expense on credit, allowing your business greater freedom to manoeuvre with the increased cash flow on hand.

Turns out, there is – with your credit cards.

Your business credit cards typically come with a pre-approved credit limit, assigned based on a number of different factors such as the length of operation, profitability and more. This credit limit is the maximum amount of credit the banks have extended towards your company’s use, and are oftentimes much higher than it would be for a personal credit card. However, this sum often goes under-utilised, and the credit card simply becomes a tool of convenience to consolidate a company’s dining, travel and entertainment expenses.

By putting a company’s payroll on the credit card, companies are able to make full use of this credit line – it’s already pre-approved and available instantly, so why not!

Many have the misconception that credit cards are tools that encourage debt, and that businesses should avoid tapping on them unless absolutely required. While it is true that credit cards come with a high interest rate for late payments, it is also an interest-free form of credit for up to the first 2 months, from the date of your transaction to when your credit card bill is due.

This makes for an extremely low-cost tool to finance your business in the short-term, and should not be overlooked.

By placing your employees’ payroll on your credit cards, delayed customer payments become less of a headache as you no longer have to worry about having to pay out your employees, freelancers and agents before your customers pay you for their jobs done. Your operations will continue running smoothly —your employees still receive their salary on time — while you only pay your credit card bills when they are due up to 60 days later.

It essentially helps to free up cash and optimises your working capital.

With this large expense put on your credit cards, you’d be able to have more working capital on hand to pursue other business goals. Businesses can hire more talents up front, stock up on their inventory, and invest in more equipment to support the growth of the company, or even to anticipate an upcoming seasonal fluctuation.

Lastly, many of us are familiar with using our credit cards to rack up miles, cash-back and points on our personal expenses — but not why do the same for your business expenses? There are many business credit cards in the market that offer some form of rebates or rewards on spend, as well as other benefits such as travel insurance, dining discounts and more!

> Here are 5 benefits of using CardUp for your business. Read more

CardUp allows you to make your business payments with your credit card, regardless of whether your recipients accept card payments or not - and this includes your payroll.

Here’s a simple guide on how you can get started on scheduling your payroll payments on CardUp - it just takes a few minutes to start making your expenses rewarding!

Unlike other payment types, for compliance reasons the payroll amount will be credited to your company’s bank account once the payment is approved.

You will still need to pay the payroll amount to your employees as per your usual process, but you now have up to almost 2 months more until the payroll charge on your credit card bill is due!

1. Sign up for a free CardUp account

If you're an existing CardUp user, log in to your account.

2. Schedule a payment

Start scheduling your payment by selecting the Payroll payment category

_HK%20B2B%20Payroll%20Payment%20Type-png.png)

3. Add your company details

Add your company details when you create a new recipient. The payroll amount will be credited to your company's bank account._HK%20B2B%20Payroll%20Recipient.png?width=700&name=New%20Screens%20(HK)_HK%20B2B%20Payroll%20Recipient.png)

4. Set up your payment

Fill in details such as your payment amount and schedule. Select your card, enter a promo code (if any), and you're good to go!_HK%20B2B%20Payroll%20Payment%20Details.png?width=700&name=New%20Screens%20(HK)_HK%20B2B%20Payroll%20Payment%20Details.png)

5. Upload documents

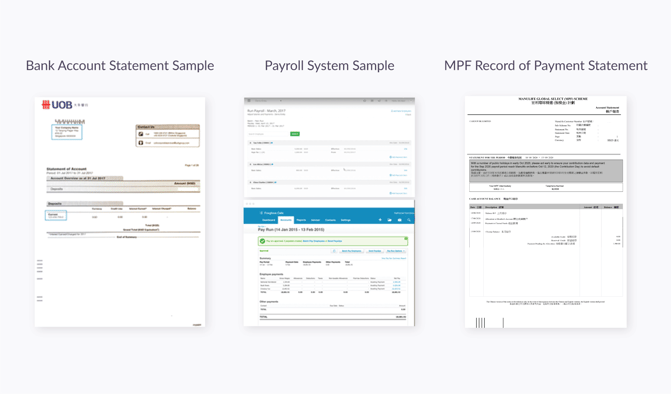

Upload your company's bank account statement to validate the bank details. You are also required to upload a payment advice - the latest MPF Record and payroll system records showing your employees' names and salaries.

_HK%20B2B%20Payroll%20Document.png?width=700&name=New%20Screens%20(HK)_HK%20B2B%20Payroll%20Document.png)

6. Review your payments

Look through the payments you've set up, click on 'Submit' and you're good to go!

_HK%20B2B%20Payment.png?width=700&name=New%20Screens%20(HK)_HK%20B2B%20Payment.png)

Scheduling your payroll payments on CardUp is simple, and just takes a few minutes. Schedule your next payroll with us now, and make your business expenses rewarding!