How CardUp helps your business maximise working capital on hand

The CardUp Team

Oct 5, 2020 12:43:00 PM

1 in 4 SMEs in Hong Kong is facing the challenge of cash flow management. These companies generate little income and are not in the position to hire the employees or invest in the resources they need to grow.

These Small to Medium Enterprise (SMEs) thus get caught in the middle; they can’t grow because they don’t have funding, and they can’t get funding because they don’t have growth.

Cash flow is the necessary lifeblood of every business. Without cash coming into their business, SMEs can’t grow, hire, purchase, or even pay their bills.

Unfortunately, 45% of Hong Kong SMEs report getting caught in this tricky scenario – in what is really a 'double credit crunch.'

In need of cash, they will continue to produce and provide goods and services for their customers, but further suffer when their customers pay them late. So, the company has extended the on-hand capital it had to please their customers, only to be caught further as they wait for payment and the cash they need to function.

Considering that only 56% of clients are paying on time, it becomes clear that why these companies face such big financial challenges in their early years of business, and these cash flow issues can cause major disruptions to the most profitable SMEs.

36% of small and medium-sized enterprises in Hong Kong find it more difficult to gain bank credit approvals, compared to the earlier financial quarters in 2020. Considering that most businesses take at least 3 years to turn a substantial profit, SMEs just starting out are stuck in the conundrum of requiring working capital, and being rejected by financial institutions because they aren’t earning enough. SMEs are getting hit from both sides - they need cash to function, they face challenges collecting from their clients, but they can’t get financing from traditional institutions to ease the cash flow issues.

Without capital to make it through collection and cash flow issues, SMEs struggle to stay afloat. So, are there alternatives to traditional financing for SMEs?

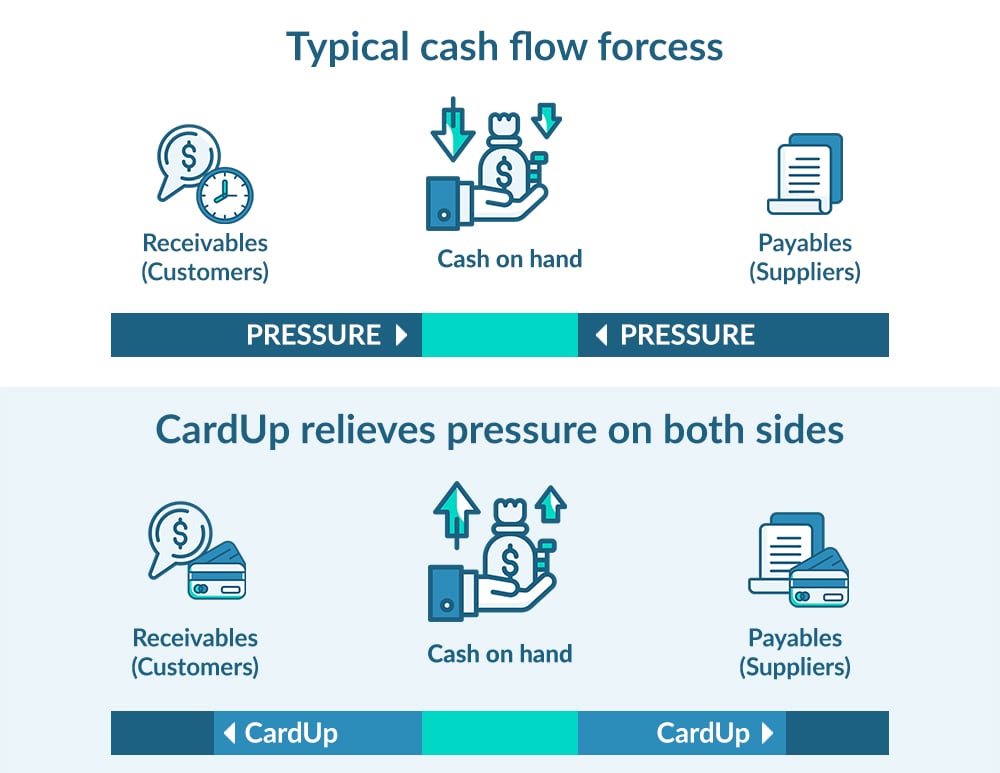

Like all businesses, SMEs take in customer payments and pay out suppliers. This is a delicate dance that can be disrupted from either side - nonpayment by customers means your SME can’t pay its suppliers. The cycle is costly and can undermine your business’s ability to survive and profit.

CardUp, an online credit card platform, can help SMEs maximise their working capital on hand and navigate their cash flow issues. Specifically, CardUp can help SMEs extend payment terms to their suppliers by enabling them to use their existing credit cards to pay their suppliers – even if that supplier doesn’t accept card payments. By doing so, companies are able to instantly access interest-free credit of up to almost 2 months, thereby freeing up working capital and improving their cash flow.

Your credit cards come with a pre-approved line of credit that is typically under-utilised, used only for smaller business payments such as travel, entertainment and transport. With CardUp, you will be able to make credit card payments for any large business expense, with no need for the recipient to be registered with CardUp. Payments such as your rent, payroll and supplier invoices can be paid by your corporate or personal credit card, freeing up a lot of the cash on hand for other uses such as growth and market expansion.

In addition to freeing up the cash you have, using your existing credit cards with CardUp will allow you to reap the benefits of paying early by allowing you to negotiate for early payment discounts many vendors offer. This can reduce your cost of goods purchased while protecting your cash on hand. Your suppliers will be paid on time, but cash only leaves your bank account when you pay off your credit card bill up to almost 2 months later.

If like the majority of SMEs you struggle to collect payments from your customers in a timely manner, CardUp can ease that pain as well. By offering your customers the option to pay with their credit cards via CardUp, they too can benefit from the almost 2-month interest-free period credit cards offer. Couple that with your own early payment discounts and you can encourage your customers to pay faster.

With no fees or payment terminal setup required by your business, this gives you a fast and easy way to start accepting credit card payments, simplifying payment collections and reducing late payments. You can also encourage your customers to schedule one-off or recurring payments, encouraging on-time payments each month or quarter.

SMEs are in an extremely vulnerable position as they may find themselves without necessary finances to withstand struggles with working capital, be they from the payables or receivables end. A tool like CardUp can help you navigate the tenuous payables-receivables maze as your SME works to grow.

If your business is facing these cash flow problems but is unable to turn to traditional bank financing, CardUp can help you better manage your working capital to prevent cash flow burdens that could potentially stifle your SME’s growth and eventual sustainability.